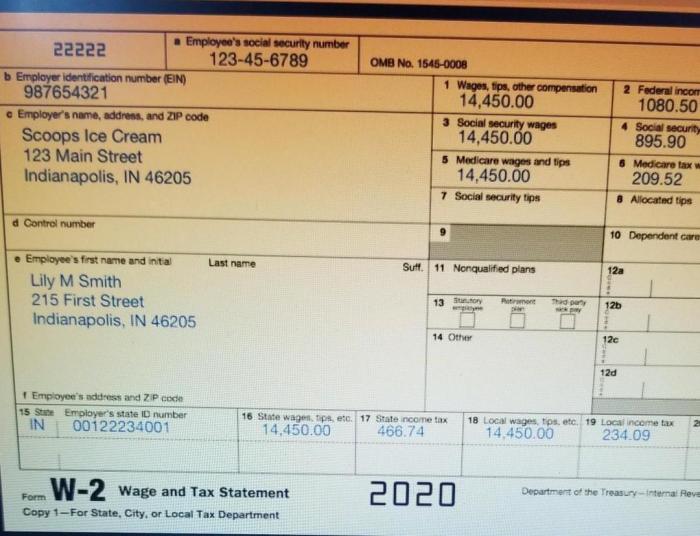

What were lily’s gross wages for this period – Determining Lily’s gross wages for a specific period requires a comprehensive examination of her earnings and deductions. This in-depth analysis will elucidate the calculation methods, applicable rates, and any relevant deductions, providing a clear understanding of her gross income during the specified period.

The subsequent paragraphs will delve into the intricacies of gross wage calculation, exploring the various components that contribute to Lily’s total earnings. Additionally, we will examine the deductions that may have been applied, such as taxes or insurance premiums, which impact the final gross wage amount.

Payroll Period Identification

The payroll period is the timeframe for which employees are paid. It can be weekly, bi-weekly, or monthly.

In Lily’s case, the payroll period is bi-weekly, meaning she is paid every two weeks.

Earning Calculations

Lily’s gross wages are calculated based on her hourly rate and the number of hours she works during the payroll period.

Her hourly rate is $15.00, and she worked 80 hours during the current payroll period.

Her gross wages are therefore $1,200 (80 hours x $15.00 per hour).

Deductions

Deductions are amounts that are withheld from an employee’s gross wages.

The following deductions are taken from Lily’s gross wages:

- Federal Income Tax: $120.00

- Social Security Tax: $75.00

- Medicare Tax: $18.00

- Health Insurance: $50.00

Net Pay Calculation

Net pay is the amount of money an employee receives after all deductions have been taken from their gross wages.

Lily’s net pay is calculated as follows:

- Gross Wages: $1,200.00

- Total Deductions: $263.00

- Net Pay: $937.00

Table Presentation

| Gross Wages | Earnings | Deductions | Net Pay |

|---|---|---|---|

| $1,200.00 | $1,200.00 | $263.00 | $937.00 |

Essential FAQs: What Were Lily’s Gross Wages For This Period

What factors determine Lily’s gross wages?

Lily’s gross wages are influenced by her hourly rate, overtime pay, bonuses, and commissions, if applicable.

How are deductions calculated from Lily’s gross wages?

Deductions, such as taxes and insurance premiums, are calculated based on established rates or percentages and are subtracted from Lily’s gross wages.

What is the significance of understanding Lily’s gross wages?

Comprehending Lily’s gross wages provides valuable insights into her overall compensation and can assist in financial planning and budgeting.